Wednesday, January 27, 2010

WE MOVED

Please join us at our new blog http://www.commecondev.wordpress.com for newly improved sexy South Los Angeles Community & Economic Development blog!

Wednesday, January 20, 2010

Some New Year's Resolutions

- Do NOT remake the mistakes (financial and otherwise) you made last year

- Do NOT re-buy things you never needed in the first place

- Do re-evaluate your spending habits

- Do re-do your budget to reflect changes in your financial situation and needs

- KEEP saving

Monday, January 4, 2010

Community & Financial Resources Fair in Photos

If you've been keeping tabs we, the good folks at CFRC, opened our doors to the community to host our first ever "Community Resources Open House". It was a great success. In addition to our sponsor for the event, California United Bank represented by Michael Richman, representatives from other financial institutions showed up with tables and pens ready to answer questions from the participants.

Midway through the event three raffles were held as well as a hearty lunch from Subway. A surprise treat was that everyone in attendance received a voucher to claim a free credit report and score from either Equifax or Transunion; courtesy of HSBC. The event attracted people from all around community and proved to be a success in introducing people to financial services. The organization found it to be such a success that another open house will be in the works for the summer (hopefully, avoiding the rain in the process).

The CFRC staff would like to thank Jeff Hernandez and David Luna of E1 Financial Credit Union, Jose Figueroa of Broadway Federal Bank, Vernell Taylor of Union Bank, Citibank and HSBC.

Michael Richman from California United Bank delivers a presentation to participants about utilizing community resources as a tool for money management.

Michael Richman from California United Bank delivers a presentation to participants about utilizing community resources as a tool for money management. -------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------

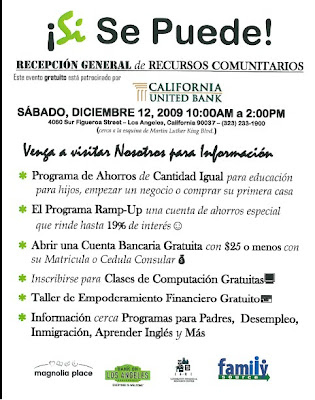

Friday, December 11, 2009

California United Bank Employees To Help Raise Financial Awareness Among Los Angeles Youth

ENCINO, Calif. – December 11, 2009 – California United Bank (OTCBB: CUNB) employees will participate in a financial empowerment seminar for about 200 Los Angeles high school students at 10 a.m. on Saturday, December 12 in downtown Los Angeles.

Save Yourself: Community Resources Open House is part of the Bank on LA campaign sponsored by the City of Los Angeles. Conducted in partnership with the Community Financial Resource Center, the four-hour event is designed to raise awareness about the benefits of banking and to direct participants to responsible financial institutions in their community. Attendees will learn about various consumer finance concepts, have the opportunity to sign up for checking and savings accounts, sign up for free beginner computer classes and obtain information on child care, unemployment and other programs for low- and middle-income families in Los Angeles.

“Improving the lives of others in our region is at the foundation of CUB’s mission,” said David Rainer, Chairman, President and Chief Executive Officer of California United Bank. “By participating in Bank on LA, we are empowering residents to make financial decisions that will positively affect them for decades to come. That in itself is a powerful responsibility and our privilege as members of this community.”

CUB will make a presentation to local residents that will focus on financial education. General concepts will include banking, budgeting and money management, consumer awareness, credit, investing and savings. Employees will also address specific issues such as credit scores, identity theft, the importance of budgeting, the risks of using alternatives to traditional banking services, emergency funds, interest, and general investment products such as certificates of deposit, mutual funds and stocks.

The event, conducted in English and Spanish, will be held at the CFRC’s office at 4060 S. Figueroa St. in Los Angeles and will also include a light lunch.

About Community Financial Resource Center

The Los Angeles Community Reinvestment Committee, d.b.a. Community Financial Resource Center (CFRC) is a non-profit 501 C-3 Community Development Financial Institution (CDFI) dedicated to providing low-cost financial services and counseling for residents and businesses in low and moderate income communities of Los Angeles County. The mission of CFRC is to create and enhance the economic wealth and capacity of the residents and businesses in disinvested areas of Los Angeles by delivering quality community development programs and facilitating collaborative efforts among business, the community and government. CFRC is recognized as the finest provider of wealth creation tools to historically under-served residents and small business owners. For more information, please visit www.cfrc.net.

About California United Bank

California United Bank provides a full range of financial services, including credit and deposit products, cash management, and Internet banking for businesses and high net worth individuals. The Bank operates from its headquarters office at 15821 Ventura Boulevard, Suite 100, Encino, CA 91436; West Los Angeles Regional Office at 1640 South Sepulveda Boulevard, Suite 114, Los Angeles, CA 90025; Santa Clarita Valley Regional Office at 25350 Magic Mountain Parkway, Suite 100, Valencia, CA 91355; Conejo Valley Loan Production Office at 4333 Park Terrace Drive, Suite 215, Westlake Village, CA 91361 and South Bay Loan Production Office at 1025 W. 190th Street, Suite 225, Gardena, CA 90248. Information on products and services may be obtained by calling (818) 257-7700 or visiting the Bank’s website at www.californiaunitedbank.com.

Contact:

David I. Rainer, President and CEO, 818-257-7776

Andrew Greenebaum, 310-829-5400

andrewg@addocommunications.com

Monday, November 16, 2009

7 Twitter Feeds You MUST Follow for Killer Savings

LearnVest Daily - 11.16.2009 by The LearnVest Staff

Forget following celebrities on Twitter; we barely have time to eat lunch. We do, however, find ourselves all over social media to get great discounts and pounce on Twitter-only deals! We follow:

AmazonMP3 tweets daily deals to over a million followers. We just downloaded about ten songs for free, including tunes from artists like Death Cab's Ben Gibbard, Taylor Swift, Kings of Convenience, Tegan And Sara, and Annie Little.

AmazonMP3 tweets daily deals to over a million followers. We just downloaded about ten songs for free, including tunes from artists like Death Cab's Ben Gibbard, Taylor Swift, Kings of Convenience, Tegan And Sara, and Annie Little. Every Tuesday, JetBlueCheeps, run by JetBlue, tweets about special last-minute flight deals. Many are as low as $69 (Washington Dulles to Fort Lauderdale, which is normally about $100!), and are only available to those in the know.

Every Tuesday, JetBlueCheeps, run by JetBlue, tweets about special last-minute flight deals. Many are as low as $69 (Washington Dulles to Fort Lauderdale, which is normally about $100!), and are only available to those in the know. Dell tweets special deals, often available only for Twitter followers. Recently, the $1,286+ Inspiron 546 MT desktop computer went for only $850 to Dell's Twitter followers.

Dell tweets special deals, often available only for Twitter followers. Recently, the $1,286+ Inspiron 546 MT desktop computer went for only $850 to Dell's Twitter followers. Whole Foods tweets about meal giveaways, special deals, free classes, party-planning tips, and updates about what produce is fresh. In between, however, there are a lot of @ replies. If the amount of those bothers you, find—and follow—your local Whole Foods store on this regional list.

Whole Foods tweets about meal giveaways, special deals, free classes, party-planning tips, and updates about what produce is fresh. In between, however, there are a lot of @ replies. If the amount of those bothers you, find—and follow—your local Whole Foods store on this regional list. Woot, a discount online store that sells one product a day, tweets their daily deal. A recent "woot" included a Gateway 11.6" Netbook for $280 (normally priced at $400).

Woot, a discount online store that sells one product a day, tweets their daily deal. A recent "woot" included a Gateway 11.6" Netbook for $280 (normally priced at $400). ShopItToMe tweets great fashion deals. For example, they tipped us off that this beautiful Vince silk halter blouse is on sale for 60% off at Nordstrom, and that this covetable J. Crew silk cami is currently on sale for $69.50 instead of $88.

ShopItToMe tweets great fashion deals. For example, they tipped us off that this beautiful Vince silk halter blouse is on sale for 60% off at Nordstrom, and that this covetable J. Crew silk cami is currently on sale for $69.50 instead of $88. CheapTweet aggregates all the best Twitter deals, based on user votes.

CheapTweet aggregates all the best Twitter deals, based on user votes.That's the LearnVest way to save…even when we're killing time on Twitter. Follow us, too! Because remember, it's not cool to be broke.

Hassan says, LearnVest is a cool personal money management tool. Check it out!

Friday, November 13, 2009

Tuesday, October 27, 2009

Here is Your Debit Card, You Have Been Warned

- Heed the Fee Just because banks no longer charge annual fees for their debit cards doesn't mean they've changed their tune. They're just being competitive. However, this doesn't mean it isn't possible to incur fees while swiping. In fact, many of us (myself included) are victims of constant, 'casual', charges that overtime will eat away at our checkings account.

The fees we are talking about are Point-of-Sale aka POS. Any time you use your PIN you are

using your check card as a debit. These types of transactions are more secure and cost less for the retailer, but be aware that there could be a charge. Better to ask before you swipe.

Earlier this year before I abandoned fast food I was at Carl's Jr. ordering when the associate remarked that I would be charged $1 for using debit. I was shocked. After all, Carl's Jr. was a regular stop for me when I used to work in Koreatown. Unbeknownst to me I was being charged every time. Hassan's Realization #20 Always check your receipt.

- When the Big Transactions are Clear, You're in the Clear Most banks process large purchases first. If you're not aware of this you could end up with costly overdraft fees. In the example below you'll find that if the bank debited the transactions in the order that the purchases were made the account holder would get stuck with one overdraft fee. However, by switching up the order, even given the same amount the account holder in this situation would actually get dinged twice. All of this done with an account that only has $100. Sounds like funny math? Look below...

And you thought you had to be careful with credit cards...

For more secrets about debit cards check this article out.